Service supplier cost analysis – Copy

Service supplier cost analysis

Service supplier cost per material and technology

This section provides detailed information about the cost of purchasing parts at external suppliers. For each technology, different applications and materials were used based on real cases.The study conducted in December 2020. For each application, several suppliers were contacted to get a good level of market prices for the different technologies. For Laser Powder Bed Fusion, a more recent study with data collected during 2023 is presented.

Requests have been made for different quantities ranging from 1 to 10 000 parts. All quotes are excluding post processing such as machining, sand blasting or other quality related processes such as tensile bars or protocols. As a benchmark, the in-house manufacturing costs are displayed based on the AMPOWER cost tool.

What you will find in this section

Laser Powder Bed Fusion

L-PBF with competitive costs at suppliers

For Laser Powder Bed Fusion, (L-PBF) quotes for 4 different applications have been requested in 4 different materials. While the materials behave slightly different, some general trends can be observed in all 4 of them.

First of all, the in-house production costs (blue dot) are usually higher than the average (grey line) for single parts. The turbine wheel produced in Inconel 718 marks an exception where already one single piece can be produced at 80% of the average supplier costs. For higher quantities, in-house production then usually develops into the cheapest alternative. Here, the aluminium alloy AlSi10Mg is an exception where suppliers remain cost competitive even for higher volumes. In general no additional cost savings can be realized above 1 000 parts.

In general, the internal cost level of 20-30% relative to external cost for higher quantities leaves interpretation for high margins. An exception to this is the AlSi10Mg market with only ~50% relative to external cost.

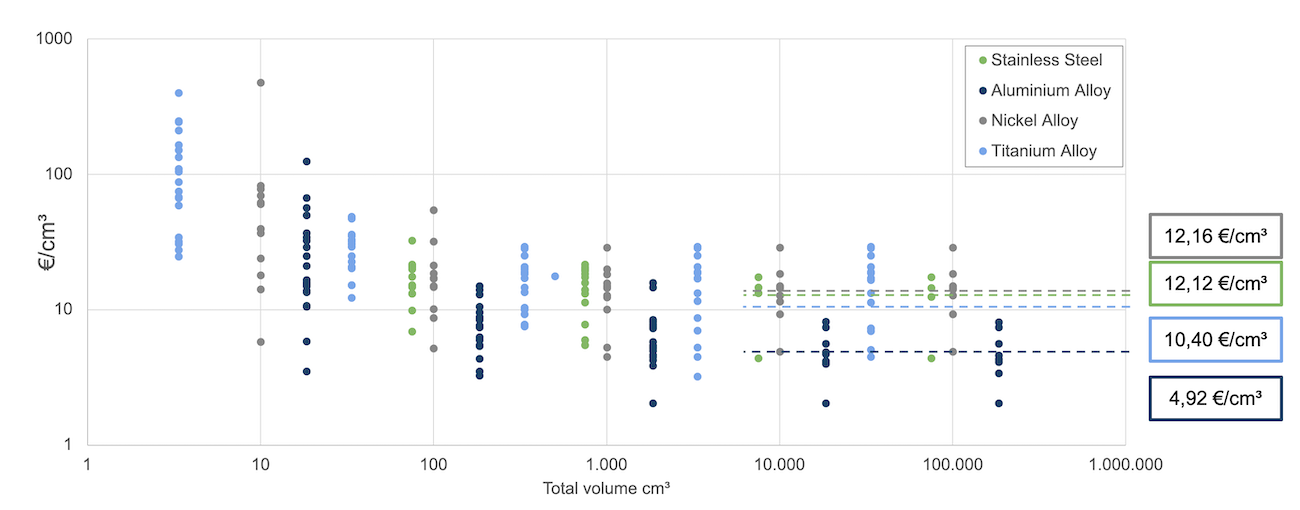

External manufacturing cost for L-PBF parts cost per volume vs. total order volume

One first thing that can be seen is a big price spread between different suppliers, especially for low volumes. Again, it can be seen that from 1.000 cm³ upwards there is no further reduction in cost per cm³.

The low cost for AlSi10Mg compared to other materials might have several reasons, among them lower material cost, a wider availability and a relatively high print speed.

Binder Jetting

Relatively high cost per cm³ at external suppliers

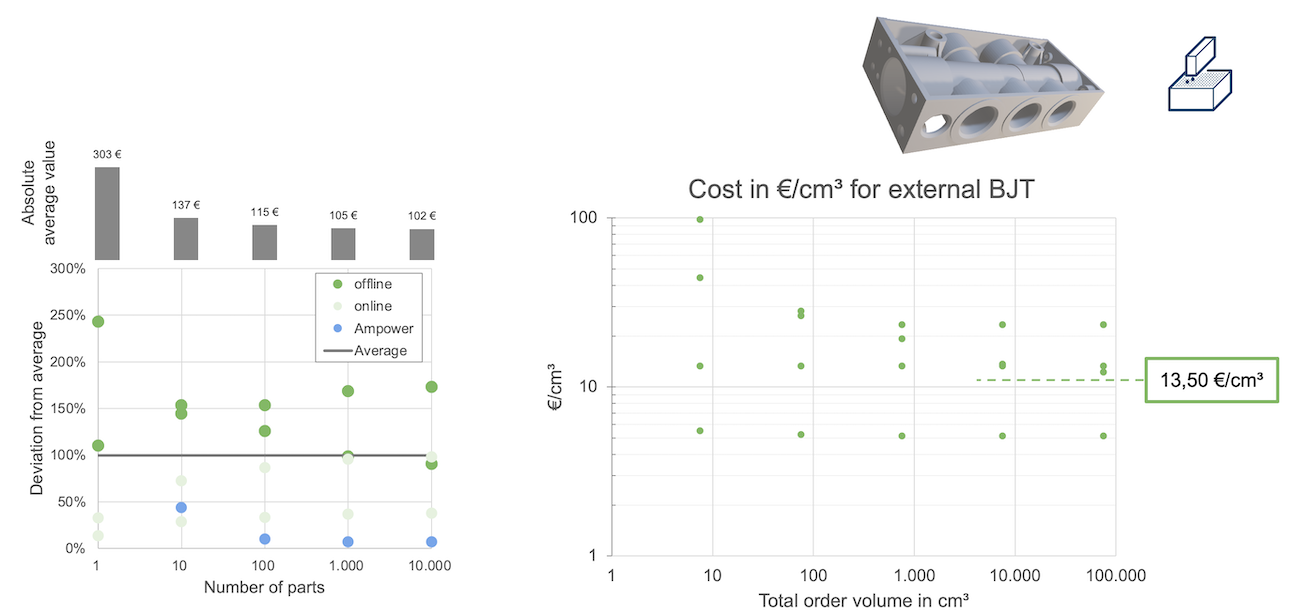

For Binder Jetting, the analyzed part is the valve block that has been discussed previously in this online learning. Again, the typical cost decline for in-house manufacturing from 50% compared to external costs for 10 parts down to less than 10% for over 1 000 parts can be observed. From an order volume of 100 parts, the average costs do not decrease significantly since already at this volume a good print job utilization can be reached.

The average cost per cm³ for higher volumes are 13,50 €. This value is still higher than for L-PBF (12,12 €), which is mainly driven by small systems and a lower availability of large, productive systems.

Material Extrusion

Little economies of scale for higher volumes

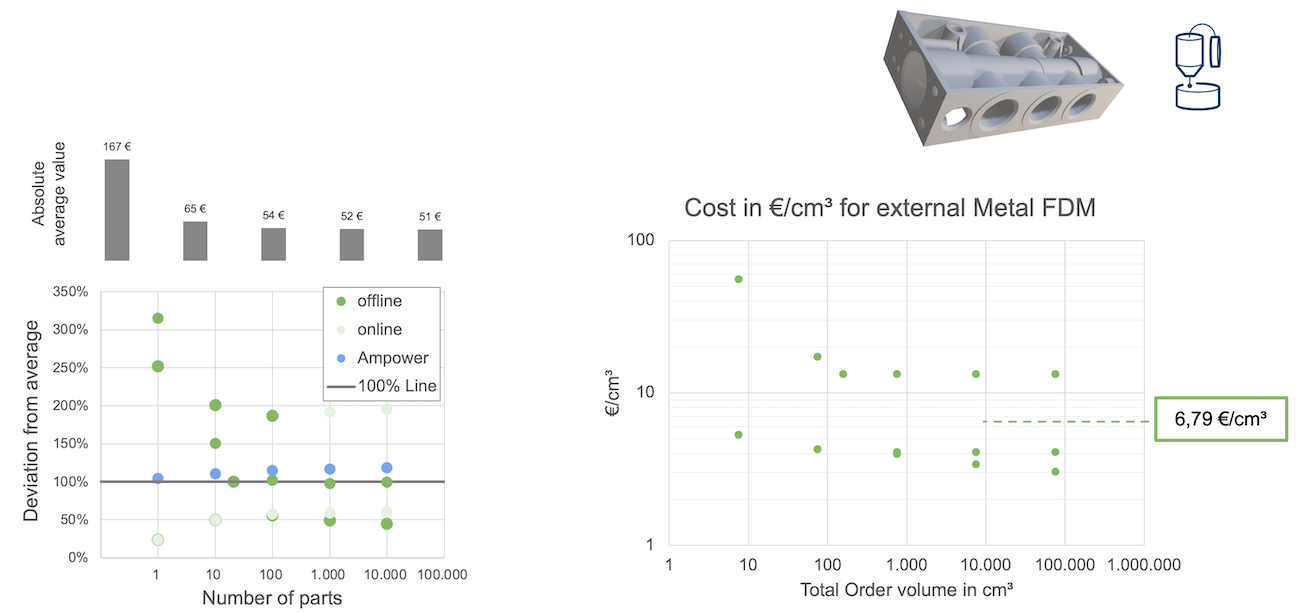

For Material Extrusion, the analyzed part is the valve block that has been discussed previously in this online learning. First of all it can be seen that the cost for in-house manufacturing are not necessarily cheaper compared to external costs and are rather average. The high spread of market prices most likely results from differences in closed to open systems.

Again, for volumes starting 100 parts almost no economies of scale can be observed.

Laser Metal Deposition

High spread between different suppliers

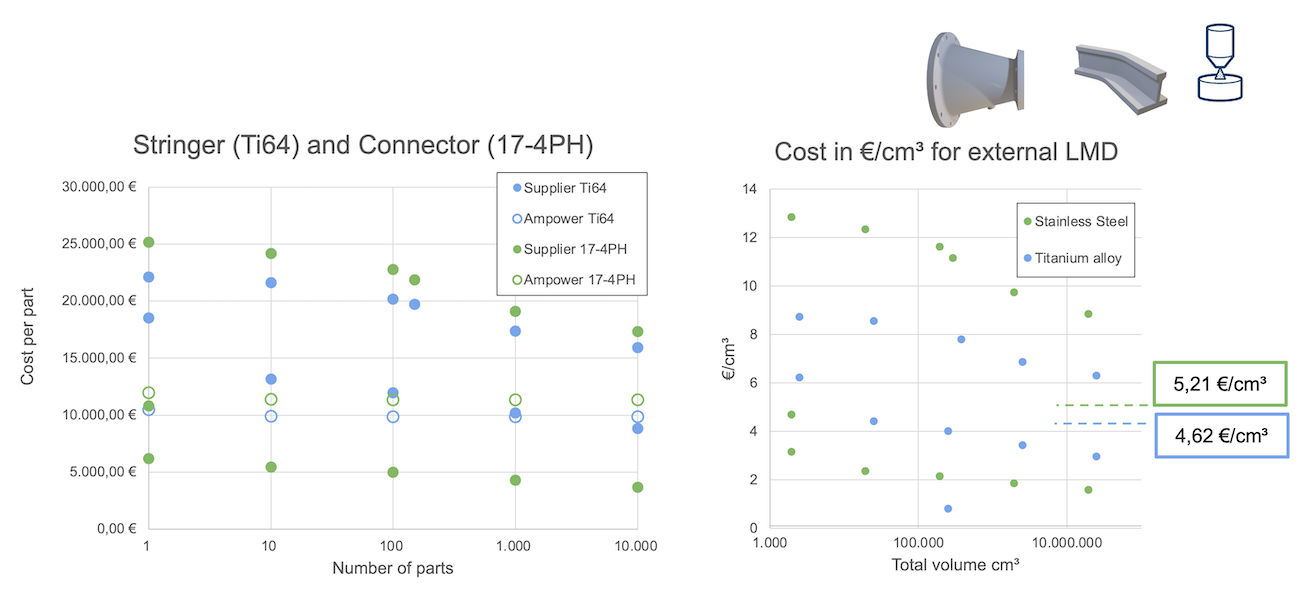

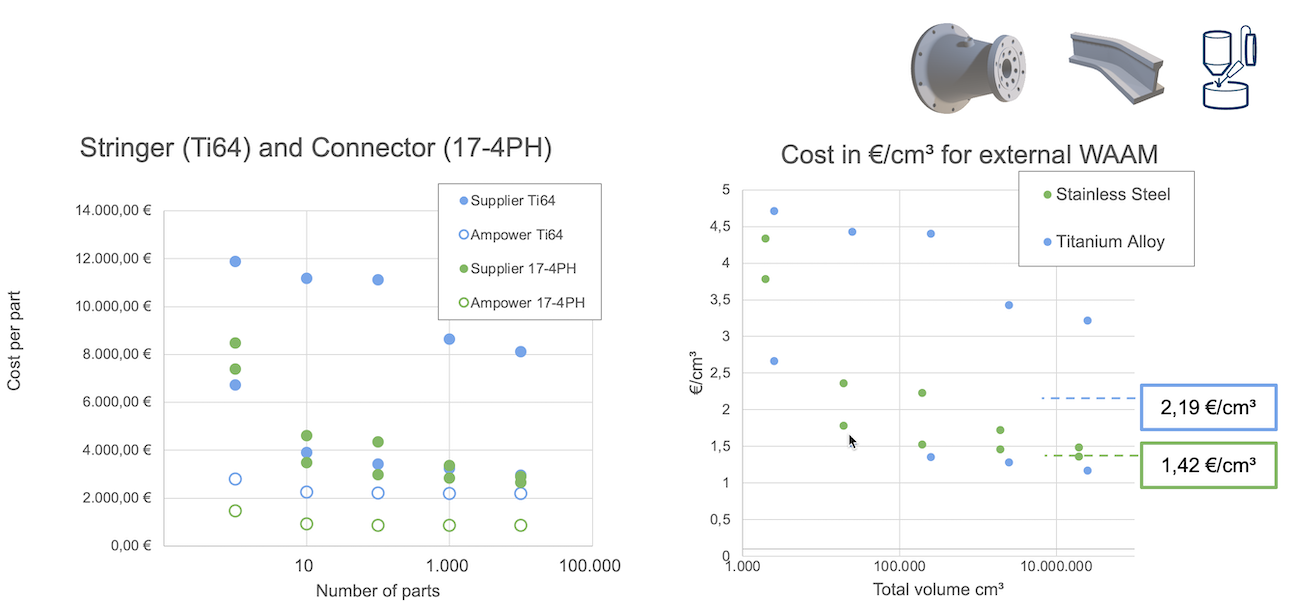

For Laser Metal Deposition (LMD), 2 different applications are analyzed: The Stringer in Titanium 64 and the Connector in Stainless Steel 17-4 PH that was discussed in the previous section. Compared to other technologies, LMD shows less economies of scale even at low volumes.. The high spread between different suppliers might result from different and difficult to compare system technology between different suppliers.

The average costs per cm³ are 5,21 € for stainless steel and 4,62 € for titanium.

Wire Arc Additive Manufacturing

Less economies of scale for WAAM

For Wire Arc Additive Manufacturing (WAAM), 2 different applications are analyzed: The Stringer in Titanium 64 and the Connector in Stainless Steel 17-4 PH that was discussed in the previous section.. As for LMD, WAAM shows less economies of scale compared to other technologies. In contrast to LMD, external costs are higher for all order volumes compared to in-house manufacturing cost.

The cost per cm³ of 2,19 € for titanium and 1,42 € for Stainless Steel are the lowest on the market today. The relatively low spread between steel and titanium most likely results from higher build rates of Ti64.

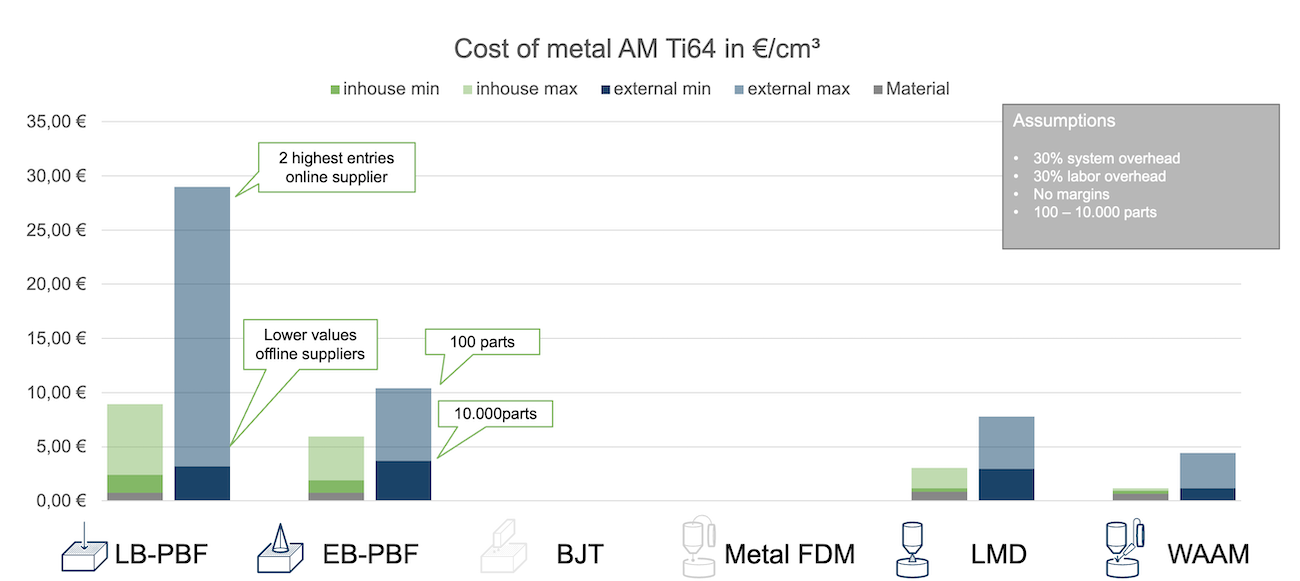

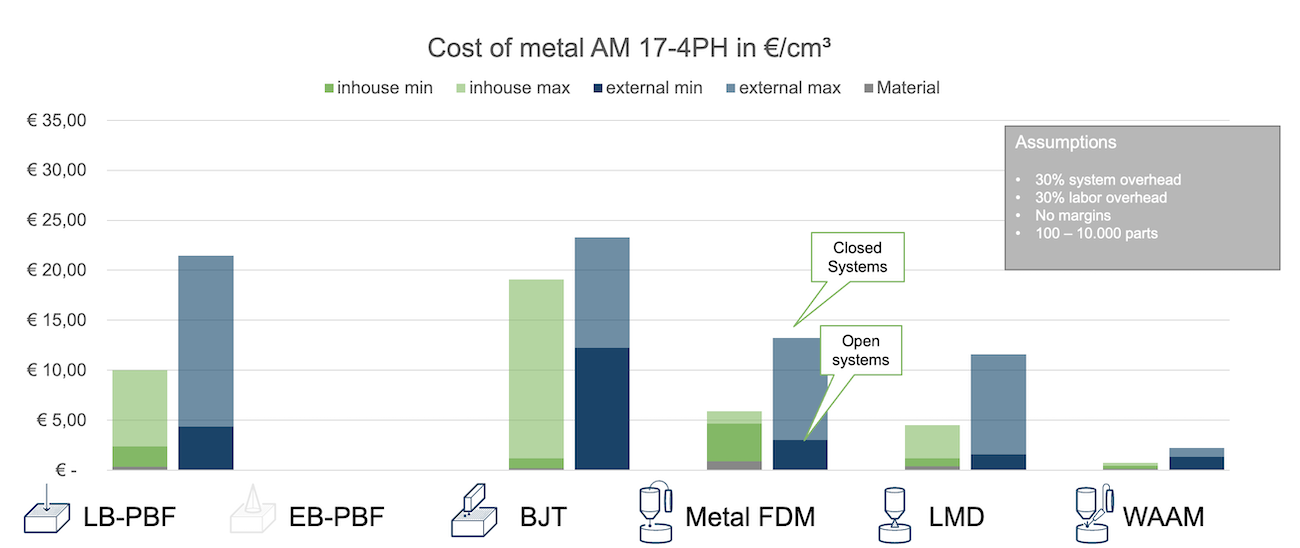

Summary cost of metal AM cost today

External manufacturing about two times more expensive than internal production

The two graphs above show a summary of metal AM cost in EUR cm³ for Stainless Steel 17-4 PH and Titanium 64 between in-house and external production for the different technologies. On a general level it can be seen that on average, external manufacturing is roughly 2 times more expensive than internal production.

Market pricing development

Steel and aluminium with strong price reduction between 2017 and 2023

In 2017, AMPOWER published its first Insights on cost of Additive Manufacturing. Comparing the average pricing of stainless steel, the price dropped by 50% from previously 750 EUR/kg 6 years ago. This indicates an increased competition on the market and a large available capacity of stainless-steel L-PBF machines at part manufacturing service bureaus and might be an explanation for prices close to in-house manufacturing cost.

A similar market pricing development is seen when looking at the average pricing of aluminum parts today and 6 years ago. The minimum price for aluminum parts has decreased by factor 3x over this timespan. However, it should be noted that for aluminum, the regional influence is significant. Especially Chinese part manufacturer are offering aluminum AM parts at very low cost while western supplier still range at a similar price level as 6 years ago.

Contrary to developments described above, the average pricing for titanium AM parts almost doubled, despite constantly reduced cost for titanium powder

over the last 6 years. Due to the difficult processability and high requirements for titanium parts, customers tend to build a tight relationship to their titanium AM supplier rather than using online platforms. Therefore, only a handful supplier offer titanium with online instant quoting. The high prices are most likely due to mark ups for risk mitigation in the quoting process.